1 Know Your Numbers

:dropcap_open:M:dropcap_close:any doctors do not really know the cost of doing business. We THINK we know about what it costs to run our practice. You may know what your monthly expenses are, but do you know the actual cost of providing an office visit? Don’t fool yourself into thinking it costs the same to adjust 10 patients as it does 25, just because you are already there.

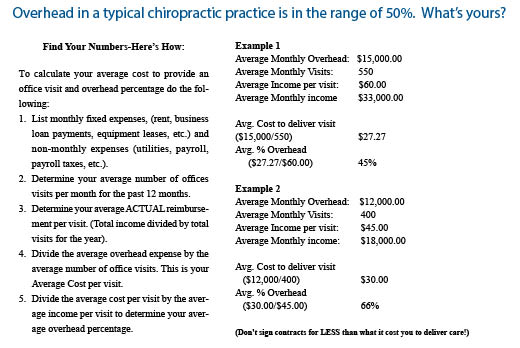

According to whose numbers you read, overhead in a typical clinic runs about 50%. Don’t assume this is your number! A recent article I read suggested the following formula to determine your overhead. While it may not be 100% accurate, it will give you a ballpark number.

Unless you know your numbers, you are at a serious disadvantage when it comes to deciding to participate in your managed care contracts or other provider agreements. While it may be great to be “on the list”, if the list you are on is paying you LESS than what it costs to provide care, you are better off being OFF the list!

Otherwise, it’s like buying oranges for a dime and selling them for a nickel and wondering why you aren’t making any money. Getting a bigger truck is NOT the solution! Signing MORE contracts for less money than the cost of providing care is NOT the answer to improving your practice! You can’t make up for a loss by increasing volume.

2 Let’ Talk Fees….or Perhaps Let’s DON’T!

You never want to “talk fees” with your colleagues. This is considered price-fixing and there is a law against it that can land you in hot water. You would be amazed how many times we hear doctors say they just asked friends around their area to see what the going rates were. This is flat out illegal…so don’t do it! Don’t take our word for it; here’s the definition of price fixing and a link to the Department of Justice:

Price Fixing

Price fixing is an agreement among competitors to raise, fix, or otherwise maintain the price at which their goods or services are sold. It is not necessary that the competitors agree to charge exactly the same price, or that every competitor in a given industry join the conspiracy. Price fixing can take many forms, and any agreement that restricts price competition violates the law. In many cases, participants in a price-fixing conspiracy also establish some type of policing mechanism to make sure that everyone adheres to the agreement. http://www.justice.gov/atr/public/guidelines/211578.htm

So, for obvious reasons, we won’t get into how much YOU should charge, but we can encourage you to at least review where you are in relation to others in your area using the resources that are available.

Knowing what ALL doctors, not just chiropractors, are charging in your area is just a good business practice to make sure you maximize your income when possible. You could be charging less and getting paid less than everyone around you and never know it. There are several resources to assist you in finding out the fees in your immediate area. You’ll want to use these resources to help you determine your ACTUAL fee. More about what your ACTUAL fee is in a few minutes.

So, How Many Different Types of Fees Can You Name?

Here is a sample list from the National Association of Heath Underwriters to get you started!

- Actual Fee – What you actually charge for a service. (Typically your “highest fee”, also known as “my normal fee” or “what I would like to get paid”!)

- UCR fee schedule – Charges of health care providers that are consistent with charges from similar providers for identical or similar services in a given locale.

- Global Fees – Negotiated fees that are all-inclusive (one fee is paid for the entire range of services provided for a specific episode or episode of care.)

- Negotiated Fees – Managed care plans and providers mutually agree on set fees for each service. This negotiated rate is usually based on services defined by the Current Procedural Terminology (CPT) codes, generally at a discount from what the provider would usually charge. Providers cannot charge more than this fee.

- Prevailing fees – Amounts charged by health care providers that are consistent with charges from similar providers for identical or similar services in a given locale.

- Allowable fees – Fees permissible by health plans, or mandated programs such as Medicare, Medicaid or Workers Compensation and PIP.

- Contracted fees – Fees agreed to under a managed care or preferred provider agreement.

- Mandated fees – Fees set by state and or federal programs such as Medicare, Medicaid, PIP and Workers’ Compensation

- Approved Amounts –The amount Medicare determines is reasonable for a service covered under Medicare Part B. It may be less than the actual charge. For many services, including physician services, the approved amount is taken from a fee schedule that assigns a dollar value to all Medicare-covered services that are paid under that fee schedule.

I am sure there are more types of “fees” but obviously this is enough to confuse the issue for most of us. Now, here is YOUR challenge. Regardless of how many types of fees there are, YOU should have ONE fee in your clinic as your “ACTUAL FEE”. Your ACTUAL FEE is part of your FEE SYSTEM.

:dropcap_open:This is a ROCK solid way to set up your fee system:quoteleft_close:

Your fee system reflects the range of fees you accept as part of your managed care agreements, your participation in mandated programs such as Medicare, Medicaid or PIP and Workers’ Comp, if they are regulated in your state.

While all of these fees may be different, this does NOT mean you have a dual fee system. Why? Because they are “contracted discounts” off your Actual Fee, or they are mandated fees set by either the state or federal government.

Did you notice that nowhere in this list did you see my cash fee, my PI fee, my workers’ comp fee, my family plan fee, my Uncle Dudley fee, or my buy 10 visits get one free fee! Why…because they shouldn’t exist!

3 Develop a Fee System and Stop Playing Let’s Make a Deal!

Your fee is your fee is your fee. Period! Or it should be!

Step back from the laundry list of “fees” you may now have in your office and start thinking in terms of “what is my ACTUAL fee” for each procedure in the clinic. Break the habit of your fee being based on payer type. Insurance companies ARE sending letters to doctors asking if they offer any type of discounts to patients, and IF so, how they are reflected on the claim form. Guess what? There is NO place on a CMS 1500 claim form to SHOW a discount. Do you smell a rat?

If you have your fee system set up properly, you should be able to answer the above question like this, “I only have one fee for my clinic services and the only time that fee is discounted is when it is part of a contractual network agreement or a documented financial hardship.” This is a ROCK solid way to set up your fee system and IF you follow it in practice, you’ll be able to practice with much more peace of mind!

Now let’s look further at this “fee system”. Within your fee system, there are layers. (UCR Fee Schedule, Contracted Fee Schedules, Mandated Fee Schedules and Hardship Agreements).

Review the diagram to better understand the Fee System Concept:

4 Build Your Fee Schedule and Your Financial Policy!

Once you’ve identified your Actual fee, then make SURE you are letting your patients, EVEN YOUR CASH PATIENTS, know these are your REAL fees! Many doctors have been giving discounts to their cash patients and have NEVER let them know what their real fees were! If you’ve been in practice very long, you’ve probably had this come back to bite you when the cash patient gets involved in an auto accident and gets the Explanation of Benefits and sees your REAL fees for the first time. NOT A PRETTY SIGHT! Once you have determined your actual fees for services, stick with them until you evaluate your fees in the next year or at some given interval.

Now let’s talk about an Office Financial Policy. Having a proper Fee System allows you to set up a simple office policy that can be summarized on a single piece of paper! Keep it simple and straight-forward.

If you find yourself or any of your staff saying, “Wait until Suzy comes back and she can review our financial policy with you” then it is too complicated. Anyone who is at the front desk should be able to discuss the basics. If they can’t, you have to ask yourself why not. Is your fee schedule really dependant upon who is paying the bill?

If your fee system is set up properly, and you have an ACTUAL fee established for your services, then the only time that you should charge LESS is when there is a contractual obligation or special circumstances. After you have set your policy, follow it! All patients should be aware of the financial policy. Here is a good example of a simple but solid policy:

What about pre-paid care plans and time of service discounts? Are they legal?

That depends on whom you ask and where you practice. In some states, collecting in advance or offering “unlimited care at a fixed fee” is considered the business of insurance and is prohibited, unless you want to go apply for an insurance license!

Some states require doctors to “escrow” the funds you have collected in advance and only draw down funds as services are rendered. IF you have determined they are legal where you practice, make sure you dig deeper just to be on the safe side. Don’t rely on the word of your colleagues who may say, “We’ve been doing that for years,” so it must be ok. Because something is commonplace does not mean it is legal.

If you are offering these plans you should find out if you can offer the plan to insured patients. Some provider agreements prohibit collecting any part of the deductible or copayments IN ADVANCE of services rendered. So, read your agreements closely. Our consultants advise us to NEVER collect in advance on federally insured patients like those with Medicare.

We obviously like patients to commit to treatment plans and pre-pay plans seem to help them stick with it. A popular alternative that avoids the problems with some pre-pay plans is a good auto-debit system that incorporates legal network discounts offered by a Discount Medical Plan Organization. This type of system allows you to offer discounts to insured patients on their NON-covered services. You simply set them up on auto-debit and have the patient sign an agreement to receive care and debit their credit card or bank account weekly, bi-weekly or monthly. You should NOT offer discounts on deductibles and co-payments, but only on non-covered services (like the visits when insurance runs out). With auto-debit, the patient is simply paying on their account, after services are rendered, which avoids the problems of collecting deductibles and copayments in advance.

I would also suggest you avoid offering free services as a reward for someone committing to 10 or 20 or X number of visits. These offers are still an inducement if someone else (like the government) is paying the bill. There is a $10,000.00 fine PER occurrence for this type of violation.

Now, a bit more about Time of Service or Prompt Payment Discounts. Here are the facts as we know them:

- Time of service discounts ARE permitted in a few states.

- Not all states define the percentage allowed.

- Even if your state DOES permit Time of Service Discounts, state laws do NOT supersede federal laws and you should be mindful of federal regulations regarding charging “Fair Market Value”.

- The OIG did issue an opinion to a hospital in 2009 indicating that between 5% and 15% could be considered a “reasonable” prompt payment discount. BUT… there were restrictions on WHEN it could be offered, and it could not be advertised (and that does not mean an ad run in a newspaper…word of mouth can constitute advertising!) There were some other caveats as well.

While a time of service discount may be permissible in some states, the problem is that far too many doctors hide behind this term when what they are really doing is trying to hide a dual fee schedule. The discounts they offer are FAR above any reasonable bookkeeping reduction. Our advice is to confirm what your state permits and, if NOT defined, err on the side of caution and follow the OIG’s guidance of 5%-15%.

5 Keep it Current!

Do you review your fees annually? Some carriers raise their fees at the first of the year, others in April and some in June. Talk to provider services and get the date on your reminder system to have someone verify the allowable; they do change and you could be leaving revenue on the table.

6 Train Your Staff!

Congratulations, you have developed a fee system, and you put it in writing, now what? Train your staff! There are rules and regulations when it comes to operating your own clinic. Is your staff up on the latest information available? If not, then you are putting them and yourself at risk! There is a wealth of information and training material available through your state association and companies/consultants that specialize in the field of chiropractic.

What you measure improves. Monitor to ensure your staff fully executes your financial policies. Review your financial policy during weekly team meetings and see if every new patient the prior week had their financial policy formally covered. You know how important a good report of findings is for patients. Treat the financial review with just as much importance. Money or confusion about responsibility is one of the top reasons patients drop out of care. This is an easy fix with a sound financial policy. If your staff receives resistance from any patients about your new policy, problem-solve it together. Talk about it and remember to congratulate them for following policy.

7 Things to Avoid!

- Do not undermine your front desk and insurance staff by talking fees with patients UNLESS that is YOUR normal office policy. Set and follow your policy and let them do the talking.

- Do not have inconsistent collection policies. Set and follow your policies on collections and apply them equally to all patients.

- Do not tweak your coding to allow for “lower fees”. This is called down coding and many doctors do this if they are trying to lower the fee to a cash patient. Consider using a proper Discount Medical Plan Organization which will eliminate the need for this improper coding and will allow you to document, code, bill, AND discount correctly.

- Do not base your fees or codes on payer type. You should have ONE fee and stick with it. The only time you should discount is when there is a contractual agreement or mandated fee schedule or the patient truly qualifies for your hardship policy. Base CPT coding on payer type ONLY if it’s required by contract or mandate.

Okay… there aren’t just 7 steps; here are a few more pointers!

8 Do you offer discounts?

If so, there are TWO areas of concern to consider:

- Legal Implications: If you do offer discounts, BE CAREFUL! Offering discounts the WRONG WAY can cost you. There are real fines and penalties associated with improper discounts and inducements. If you’d like to review an article on the legalities of offering discounts go to www.chirohealthusa.com/DoingTheRightThing

- Financial Implications: You must know your profit margin to determine if the discounts you are offering allow you to remain profitable. We see far too often that docs are willing to offer discounts without regard to their expenses or maintaining a profit margin. What they fail to realize is that offering a discount to the uninsured or underinsured may be helpful, but it should also be reasonable and not at or below your cost of rendering the services.

How can a discount impact your practice? Did you know that if you were seeing 100 patients a week, and you collected 100.00 per visit, that if you decided to cut your fees by 25% to “attract” more patients, you would literally have to see 133 visits to collect the same revenue! So do the math and make sure you are maximizing reimbursement by at least having your Actual Fee at UCR for your community, and if you offer discounts, offer them within reason and make sure you aren’t charging less than what it costs you to deliver the care.

9 Action Steps!

- Review and set your fees – Determine your ACTUAL fee and stick with it!

- Implement your Financial Policy based on your Fee System

- Consider joining a DMPO if you are offering discounts. These plans allow you to document correctly, code correctly, bill correctly and, IF you are offering discounts, discount correctly and practice with more peace of mind.

Article submitted by ChiroHealthUSA

Dr. Foxworth is a certified Medical Compliance Specialist and President of ChiroHealthUSA. A practicing Chiropractor, he remains “in the trenches” facing challenges with billing, coding, documentation and compliance. He is a former President of the Mississippi Chiropractic Association and served 12 years on the Mississippi State Board of Health. He is a Fellow of the International College of Chiropractic, as well as member of the ACA. You can contact Dr. Foxworth at 1-888-719-9990 or [email protected]