For most chiropractic professionals, your practice is your most important asset. If you’re considering selling it, how do you place a price tag on its worth? You have to remember that the practice’s value is in the mind of the beholder–not in what you think it is worth. That is often mistake #1 for sellers.

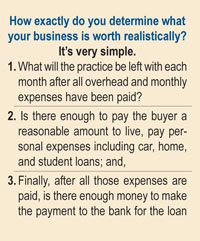

Sure, you may think your practice is worth a million dollars, but it depends on what the market is going to bear and, more importantly, what the bank will loan to the buyer. And how exactly do you determine what your business is worth realistically? See sidebar.

If there is not enough cash flow to meet all these needs, the bank, the SBA (Small Business Administration), or any reasonable lender will not fund the transaction. So, in the end, two things have to be met in most practice sales: #1) Does the buyer value the practice at the determined sale price? and #2) Does the lending institution value the practice where the cash flow of the practice can pay all expenses, including their loan payment, and still leave enough for the buyer to survive each month?

Value is in the eye of the beholder—the bank!

To understand what your practice is worth realistically–you have to look at what you could sell it for. There are a few factors to take into account: assets and equipment, accounts receivable, and the value of your current business—which really means monthly cash flow. None of these are as clear-cut as they seem.

For example, your equipment has a certain dollar value–maybe even an adjusted value. But what really matters is how much did that equipment contribute to the generation of revenues for the practice. Secondly, how old is the equipment and how close is it to needing to be replaced. Will a buyer really want a 20 year old X-ray machine, or is it something they’d want to replace anyway? Or is it necessary to have four ultrasound machines when only 2 are used in the generation of revenues?

You must also consider that accounts receivable are not always 100% collectible—not to mention there is a cost involved in collecting them. AR is often discounted a minimum of 25%, if it is less than 90 days old, and the amounts over 120 days are often discounted anywhere from 25-75%. The buyer needs to analyze the AR and determine if they are PI cases that will likely close or are they bad debt cases that haven’t had a payment made on them in 6-12 months and the likelihood of ever collecting is 10%.

Blue sky or practice gold. Talking about patient files? There is difficulty in placing a value on your current patient business. Some have suggested it should be what the business has collected in the past year; others say a formula based on the past three years. But both of these answers are incorrect.

What really matters when it comes time to placing a dollar value on your business is what the cash flow will be for the potential buyer. The average buyer will be going to a bank for a loan, so the value of your business (and what it could potentially be sold for) needs to be evaluated the way a bank would look at it.

Cash Is King!

How a bank will look at a potential business purchase is by discovering the cash flow potential. Here’s how this works. The bank needs to ensure the new buyer would be able to pay the current practice overhead and still have money for the buyer to live and make the bank payment. You have to work the numbers backwards to see if your business is a worthwhile investment for the potential buyer and the lending institution.

For example, if your business has estimated $25,000 monthly revenue from collections on services and other practice income, that’s where you’d start. Then you’d subtract your overhead–that includes staff, rent, supplies and utilities. You must also include annual expenses that need to be broken down into monthly increments, such as malpractice, workers comp/liability insurance and other non-monthly expenses. In this example, let’s say that practice has these expenses each month at $15,000. Let’s also subtract an additional $4,000 for living expenses for the potential buyer. It is likely the buyer will have a family to support, car payments, and student loans. And don’t forget about the $4,200 bank payment–the lending officer certainly won’t! That leaves your potential buyer with less than $2,000 remaining per month. That number is going to look slightly risky for the buyer and for the bank. In fact, if your backwards math comes out like this, you may need to adjust your price based on the data, or find a way to lower overhead. Your tax returns will tell the story to the buyer. Any normal buyer will never buy your practice without reviewing the last 3 years tax returns of the practice or of you personally, if not a corporation.

Making the Numbers Work

What do you do if your numbers don’t come out attractive enough to attract a buyer and their lender? You need to change the formula and consider carrying part of the sale price personally, which many banks won’t allow and I don’t recommend, except in special circumstances. Or, change your practice to prepare for the eventual sale. Change to improve it so that it is more attractive when the buyer starts comparing practices. This is why planning for at least 3 years ahead of when you want to sell can be important. It’s not likely you’ll change the cost of living for your potential buyer or the interest rate at their lending institution. But you can make a difference in the overhead column or on your clinic collections.

There is actually one way to impact both. The best way to make your practice more efficient today and more appealing for future sales is to move to a fully integrated electronic office—one with an end-to-end solution with documentation, true electronic health records, billing, scheduling, and patient education. The efficiency created with technology can help you lower the overhead of your practice and also increase revenues with alerts and reminders in an electronic health record (EHR). Secondly, an office that has already prepared itself to be compliant and set up with EHR, electronic billing, and improved digital documentation software systems will appeal to the younger doctors who were born with a computer mouse in their hand.

Present day buyers expect a computerized office and—one that has a system in place—will more likely garner more favor when comparing similar practices to purchase. And soon a paper office will become virtually obsolete with the American Recovery and Reinvestment Act’s (ARRA) incentive of up to $44,000 for providers who adopt certified electronic health records. Ultimately, a digital office will help you become more efficient, handle more patient volume, less paperwork and obtain a higher sale price or at least position your practice at the top of the list of potential buyers.

Putting It All Together

When you consider selling your practice–take a long look at your cash flow and profits. It’s important to think like today’s buyer–they are younger, mobile, and technologically savvy. They demand a digital office and are interested in a business that will qualify for lending.

Be realistic about your price tag. Will your buyer’s bank agree with your assessment? Is your business a profit-maker after the bank loan payment is made?

Now is the time to consider investing in an EHR. You can use available funds to offset the cost of enhancing your practice. Depending on when you adopt an EHR, you may be able to take advantage of the ARRA’s $44,000 incentive. It will be an investment to increase efficiency now and add value to the practice for later when you choose to sell. Plan several years ahead to keep your practice viable as a clinic that will sell in the future and give you the return you deserve for your years of developing its value.

Dr. Steven J. Kraus is CEO of Future Health, Inc., a company that partners with chiropractors to deliver a comprehensive clinic management solution, including fully-integrated EHR. Dr. Kraus is a recognized expert in building successful clinics, having developed and sold 18 practices of his own and provided strategic consulting services to more than 400 healthcare businesses. Contact Dr. Kraus at [email protected] for more information.