If you think you can’t afford to “get compliant,” it’s time for you to pull out a calculator and do the math.

The average 24 visit Medicare case is worth approximately $950 of revenue in covered services and co-insurance. But, this is only true if the carrier pays on an errorless claim or without asking for notes.

Unfortunately, if the carrier delays payment, you are forced to allocate your practice’s resources to defeating the denial and preparing the appeal. The case value would be reduced by over 70% because the average appeal costs almost $700 in staff time, lost interest and hard expenses, if the case has to go all the way to the Administrative Law Judge level. Based on reports from the second level appeals performed by the independent reviewers (The QIC), the chances of having to appeal to the Administrative Law Judge level to “win” your money is highly likely. This is because the QIC produces a totally favorable opinion where all the claims in question are paid only 28% of the time.

The startling part is that the amount of lost revenue doesn’t include the income from lost new patients due to the doctor´s not marketing because of the time and mental effort spent on reviewing charts and preparing case summaries. Just imagine how much worse it would be if the practice was in a full blown audit and the doctor had to spend months or even years defending his/her practice, his/her income and his/her family’s way of life.

As we have seen in Florida, New York and California, the new Recovery Audit Contractors (RAC’s) have already recovered over $1 billion in overpayments based on audits that rely solely on the practices’ billing profiles. With this program going live nationwide in October 2009, the chances of audits spreading throughout the chiropractic profession has increased significantly.

Because of this, it is imperative to start defending your practice and your income and, unfortunately, an ineffective program just won’t do. You lose money as soon as Medicare denies your claim and it’s not enough to be right, you have to be so right that nobody questions you, because, once you are questioned and start getting denials, you may win the appeal, but it is a symbolic victory. You may have won the battle but, in reality, you’ve lost the profit margin war.

Trying to ensure you meet medical necessity requirements without total and complete understanding of medical necessity rules and contract provisions is a risky business proposition. If a first-level review, for example, doesn’t solidify reimbursement, your claim will be subjected to a second-level review by the carrier. If that appeals submission does not prove necessity, the delays and costs continue to escalate.

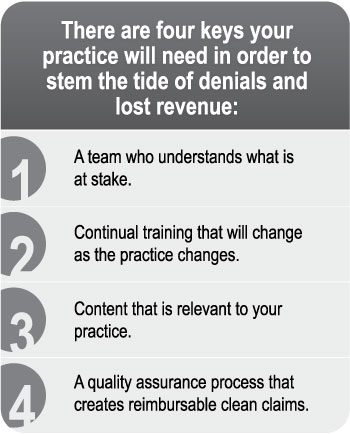

In order to implement these 4 keys (see table), you might have help from a team of physicians that have different strengths and competencies or you will do everything yourself. In either case, your compliance officer will need to find information that will train you and your staff to become experienced in Medicare rules and regulations, managing appeals, utilization management, and understanding internal audit compliance, just to name a few. A compliance program and quality assurance process is necessary to ensure your medical decision-making is consistent. In addition, you need to provide your staff with access to content to include standard of care, correct coding and evidence-based consensus standards.

This information you need is plentiful and easily available on the internet. You can go to your local carrier’s website and download their policy for chiropractic reimbursement.

Dr. John Davila is a 1994 graduate of Palmer College of Chiropractic in Davenport, IA, and practiced in the Myrtle Beach, SC, area for 13 years. Since 2000, he has been consulting with insurance companies and doctors in private practice in the areas of coding and documentation. In 2001, he re-wrote the Medicare LCD coverage policy for Palmetto GBA (SC Medicare). His company, Compliant Services & Solutions, Inc., helps doctors of chiropractic to ethically maximize their practices, while avoiding audits and repayments to insurance carriers. You can reach Dr. Davila, toll free, at 1-877-322-6203 or by email at [email protected] or on the web at www.ComplaintUSA.com.

Dr. John Davila is a 1994 graduate of Palmer College of Chiropractic in Davenport, IA, and practiced in the Myrtle Beach, SC, area for 13 years. Since 2000, he has been consulting with insurance companies and doctors in private practice in the areas of coding and documentation. In 2001, he re-wrote the Medicare LCD coverage policy for Palmetto GBA (SC Medicare). His company, Compliant Services & Solutions, Inc., helps doctors of chiropractic to ethically maximize their practices, while avoiding audits and repayments to insurance carriers. You can reach Dr. Davila, toll free, at 1-877-322-6203 or by email at [email protected] or on the web at www.ComplaintUSA.com.